The Complete Guide to Streamlining Vendor Payments While Maximizing Cash Flow and Earning Rewards

Are you spending countless hours each month on vendor payments? Frustrated by limited payment options and disconnected financial systems? You’re not alone. Small business owners waste an average of 20 hours monthly on payment processing tasks that could be automated, resulting in thousands of dollars in lost productivity.

What if you could reclaim that time, eliminate payment headaches, and even earn rewards on every vendor payment—regardless of whether they accept credit cards?

Melio payment processing is transforming how small businesses handle accounts payable, offering a rare combination of simplicity, flexibility, and cost-effectiveness that traditional payment solutions simply can’t match.

Try Melio’s free plan today and transform your payment process →

In this comprehensive guide, we’ll explore how Melio is changing the game for small business payments, helping you save time, reduce costs, and gain unprecedented payment flexibility.

Table of Contents

•What is Melio Payment Processing?

•Transformation #1: Pay Any Vendor by Credit Card (Even When They Don’t Accept Cards)

•Transformation #2: Seamless QuickBooks Integration

•Transformation #3: Automated Payment Scheduling and Reminders

•Transformation #4: Flexible Payment Approval Workflows

•Melio vs. Competitors: Why Melio Stands Out

•Transformation #5: International Payment Capabilities

•Transformation #6: Free ACH Payments

•Transformation #7: User-Friendly Mobile App

•Melio Pricing Plans Explained

•How to Get Started with Melio (Step-by-Step Guide)

•Real Business Success Stories with Melio

•Conclusion: Transform Your Payment Process Today

What is Melio Payment Processing?

Melio is a comprehensive B2B payment solution designed specifically for small businesses. Founded by Matan Bar, Ilan Atias, and Ziv Paz, Melio has quickly grown to serve over 100,000 small businesses across the United States, processing billions in payments annually.

The platform was born from a simple observation: while consumer payments have been revolutionized by digital solutions, small business payments remain stuck in the past—reliant on paper checks, manual processes, and limited payment options.

Melio’s mission is to keep small business in business by simplifying their payment processes. The platform allows businesses to pay vendors and contractors using their preferred payment method, while vendors receive payments in their preferred format—whether that’s ACH transfer, paper check, or other methods.

Key features that set Melio apart include:

•Payment flexibility: Pay by ACH, check, or credit card—even to vendors who don’t accept cards

•QuickBooks integration: Seamless two-way sync with QuickBooks

•Free basic plan: No monthly subscription fees for essential features

•Scheduled payments: Set future payments to avoid late fees

•Approval workflows: Multi-level approval for larger organizations

•International payments: Pay vendors worldwide in USD or local currency

•Mobile app: Manage payments on the go

Melio is designed for small to medium-sized businesses across all industries, including retail, professional services, manufacturing, construction, and e-commerce. The platform is particularly valuable for businesses that:

•Process 10+ vendor payments monthly

•Want to optimize cash flow

•Need better visibility into payment status

•Seek to reduce payment processing time

•Use QuickBooks or other accounting software

•Want to earn credit card rewards on vendor payments

If you’re looking to streamline your marketing efforts alongside your payment processes, efficient payment processing is a crucial foundation.

According to small business payment statistics, 82% of small businesses still use paper checks for vendor payments, spending an average of 15 hours monthly on manual payment tasks. Melio users report reducing this time by up to 80%.

Experience the simplicity of Melio payment processing →

Transformation #1: Pay Any Vendor by Credit Card (Even When They Don’t Accept Cards)

One of Melio’s most game-changing features is the ability to pay any vendor by credit card—even if they don’t accept card payments. This innovative approach solves a major pain point for small businesses: the disconnect between how they want to pay and how vendors want to be paid.

How It Works

1.You select credit card as your payment method in Melio

2.You enter your card details and complete the payment

3.Melio charges your card and collects a 2.9% processing fee

4.Melio sends the payment to your vendor via their preferred method (typically ACH or check)

5.Your vendor receives the payment without even knowing you paid by card

This process creates a win-win situation: you get the benefits of paying by credit card, while your vendor receives payment in their preferred format.

Key Benefits

•Extended cash flow: Pay vendors immediately while leveraging your credit card’s grace period

•Rewards accumulation: Earn points, miles, or cash back on payments that normally wouldn’t qualify for rewards

•Simplified reconciliation: All payments appear on your credit card statement

•Emergency flexibility: Meet payment deadlines even when cash is tight

For businesses with significant monthly vendor payments, the rewards potential is substantial. Consider this example:

Case Study: Johnson ManufacturingMonthly vendor payments: 50,000Creditcardrewardsrate:2Monthlyrewardsearned:50,000 Credit card rewards rate: 2% cash back Monthly rewards earned: 50,000Creditcardrewardsrate:2Monthlyrewardsearned:1,000 Annual rewards: 12,000Annualcreditcardfee:12,000 Annual credit card fee: 12,000Annualcreditcardfee:95 Net annual benefit: $11,905Even after accounting for Melio’s 2.9% fee, the business still nets significant value from the rewards program for payments they would make regardless.

The ability to pay by card also provides crucial flexibility during cash flow crunches. Rather than delaying vendor payments or seeking short-term financing, you can use your credit card’s grace period to bridge temporary gaps.

“We’ve earned over $8,000 in travel rewards this year just by running our regular vendor payments through Melio,” says Michael Torres, owner of a small marketing agency. “The best part is that our vendors still get paid exactly how they prefer.”

If you’re looking to optimize your checkout process for your own customers, you’ll appreciate how Melio optimizes the payment process for your vendors.

According to credit card rewards optimization experts, business credit cards typically offer 1-5% back on purchases, with many providing enhanced rewards in specific categories. By routing vendor payments through credit cards via Melio, businesses can maximize these rewards programs.

Start earning rewards on vendor payments today →

Transformation #2: Seamless QuickBooks Integration

For the millions of small businesses using QuickBooks, Melio offers one of the most seamless and comprehensive integrations available in the payment processing space. This integration eliminates the tedious double-entry and reconciliation headaches that plague many accounting workflows.

Two-Way Sync Capabilities

Unlike competitors with limited one-way integrations, Melio provides true bidirectional synchronization with QuickBooks:

•Bills sync from QuickBooks to Melio: Any bill entered in QuickBooks automatically appears in Melio, ready for payment

•Payments sync from Melio to QuickBooks: When you pay a bill in Melio, the payment is automatically recorded in QuickBooks

•Vendor details sync both ways: Update vendor information in either system, and changes propagate to the other

•Payment status updates: Payment status in QuickBooks updates automatically as payments progress

This comprehensive integration saves hours of manual data entry and virtually eliminates reconciliation errors.

Setting Up the Integration

Connecting Melio to your QuickBooks account takes less than five minutes:

1.In your Melio dashboard, navigate to “Integrations”

2.Select QuickBooks and click “Connect”

3.Log in to your QuickBooks account when prompted

4.Select the data you want to sync

5.Choose your sync preferences

6.Complete the connection

Once connected, you can customize which elements sync and how frequently, giving you complete control over your accounting workflow.

Comparison with Competitors

“The QuickBooks integration was the main reason we chose Melio,” explains Sarah Johnson, a small business accountant. “With our previous solution, we were constantly fixing sync errors and manually updating payment statuses. Melio just works—it’s saved us at least 5 hours every week.”

For businesses looking to streamline their payment processing while maintaining accurate accounting records, this integration is invaluable.

According to accounting integration best practices, seamless financial data flow between systems can reduce accounting errors by up to 90% and save 5-10 hours weekly for the average small business.

Simplify your accounting with Melio’s QuickBooks integration →

Transformation #3: Automated Payment Scheduling and Reminders

Late payments cost small businesses in multiple ways: damaged vendor relationships, late fees, missed early payment discounts, and the stress of managing payment deadlines. Melio’s automated scheduling and reminder system eliminates these problems by putting your payment calendar on autopilot.

Key Scheduling Capabilities

•Future payment scheduling: Set payments weeks or months in advance

•Recurring payment automation: Configure regular payments for consistent bills

•Batch payment processing: Schedule multiple payments at once

•Payment calendar view: Visualize upcoming payment obligations

•Email and mobile reminders: Get notified before payments are processed

•Payment status tracking: Monitor the progress of all scheduled payments

The system is designed to be flexible, allowing you to schedule payments based on due dates while controlling exactly when funds leave your account.

Benefits of Automated Scheduling

•Elimination of late fees: Never miss a payment deadline

•Improved vendor relationships: Consistent, on-time payments build trust

•Better cash flow planning: Visualize upcoming payment obligations

•Reduced administrative time: Set and forget regular payments

•Peace of mind: Confidence that bills will be paid on time

The reminder system complements the scheduling functionality by keeping you informed without requiring constant monitoring. You’ll receive notifications:

•When payments are scheduled

•Before payments are processed

•When payments are completed

•If there are any issues requiring attention

“Before Melio, we were paying about $200 monthly in late fees simply because we’d forget to process payments on time,” says David Chen, a retail store owner. “The scheduling feature has completely eliminated those fees, and our suppliers are much happier with us.”

If you’re also looking to boost conversions on your website, the same principles of automation and optimization apply.

According to research on the cost of late payments, small businesses lose an average of $3,000 annually to late payment fees, with the indirect costs of damaged vendor relationships being even higher. Automated payment scheduling eliminates these unnecessary costs.

Eliminate late payments with Melio’s scheduling features →

Transformation #4: Flexible Payment Approval Workflows

As businesses grow beyond a single owner-operator, payment controls become increasingly important. Melio’s customizable approval workflows provide the perfect balance between payment efficiency and financial control.

Customizable Approval Structures

Melio allows you to create approval workflows tailored to your business needs:

•Single approver: One person reviews and approves all payments

•Sequential approval: Payments move through a predefined approval chain

•Threshold-based approval: Different approval requirements based on payment amount

•Role-based permissions: Limit what actions each team member can take

•Approval notifications: Automatic alerts when payments need review

•Mobile approvals: Approve payments on the go via the Melio app

These flexible structures adapt to businesses of all sizes, from small operations with basic oversight needs to growing companies with complex approval hierarchies.

Setting Up Approval Workflows

Creating an approval workflow in Melio is straightforward:

1.Navigate to “Settings” in your Melio dashboard

2.Select “Team & Permissions”

3.Add team members with their email addresses

4.Assign roles and permissions to each member

5.Configure approval rules based on amount thresholds

6.Save your workflow configuration

Once configured, the system automatically routes payments through the appropriate approval channels, notifying relevant team members when action is required.

Benefits for Growing Businesses

•Enhanced financial control: Prevent unauthorized payments

•Reduced fraud risk: Multiple eyes on payment processes

•Maintained payment efficiency: Approvals happen digitally, without paper routing

•Clear accountability: Track who approved what and when

•Scalable structure: Easily adapt as your team grows

•Audit trail: Complete history of payment approvals for compliance

“As we grew from 3 to 15 employees, managing who could make payments became a real challenge,” explains Jennifer Martinez, operations manager at a consulting firm. “Melio’s approval workflows let us maintain control without creating bottlenecks. Our accounting team prepares payments, department heads approve them, and I have final oversight on larger amounts.”

For businesses that also need to create professional voice content for their marketing, the same principles of workflow efficiency apply.

According to payment approval best practices, implementing structured approval workflows can reduce payment errors by up to 80% and significantly decrease fraud risk. Melio makes these best practices accessible to businesses of all sizes.

Implement secure payment approvals with Melio →

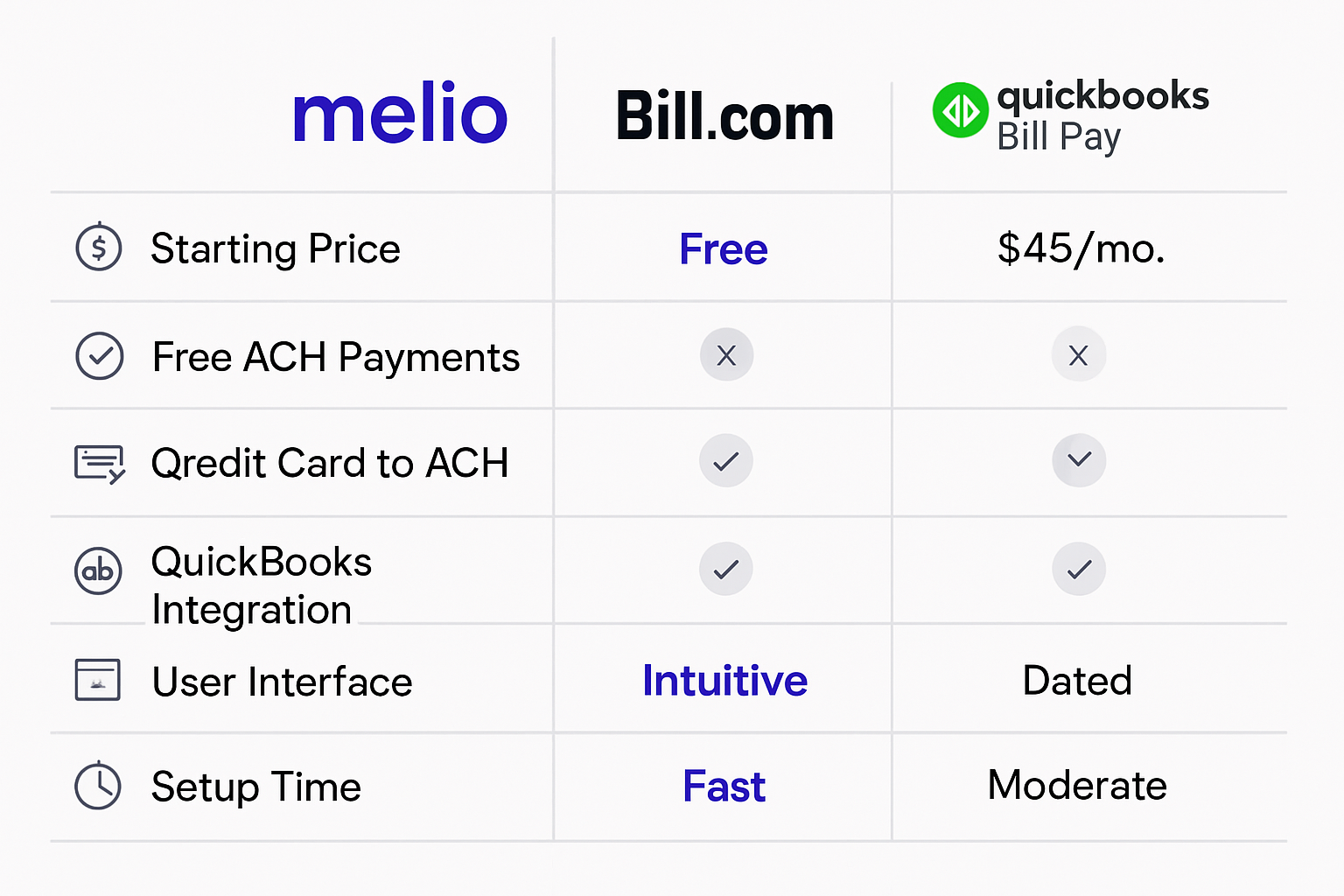

Melio vs. Competitors: Why Melio Stands Out

The B2B payment processing landscape is crowded with options, but Melio distinguishes itself through a unique combination of affordability, functionality, and ease of use. Let’s see how it compares to the leading alternatives:

Comprehensive Comparison Table

| Feature | Melio | Bill.com | QuickBooks Bill Pay |

| Starting Price | $0 (Free plan) | $45/month | $15/month + fees |

| Free ACH Payments | 5-50/month (plan dependent) | None | None |

| Credit Card to ACH | Yes (2.9% fee) | No | No |

| QuickBooks Integration | Seamless two-way sync | Yes, but limited | Native |

| International Payments | Yes | Yes | Limited |

| Approval Workflows | Yes | Yes | Limited |

| User Interface | Modern, intuitive | Complex | Moderate |

| Mobile App | Yes | Yes | Yes |

| Setup Time | <10 minutes | 1-2 hours | 30+ minutes |

| Customer Support | Email, chat | Email, phone (paid plans) | Email, phone (paid plans) |

| Free Trial | Forever free plan | 30 days | 30 days |

| Best For | Small businesses seeking simplicity | Larger businesses with complex needs | QuickBooks power users |

Price Comparison Analysis

The pricing difference between Melio and its competitors is substantial:

•Melio: Starts at $0/month with free ACH payments

•Bill.com: Starts at $45/month plus transaction fees

•QuickBooks Bill Pay: $15/month plus per-transaction fees

For a small business processing 20 payments monthly, the annual cost comparison is eye-opening:

•Melio (Core plan): $300/year

•Bill.com: $540/year + transaction fees

•QuickBooks Bill Pay: 180/year+transactionfees(approximately180/year + transaction fees (approximately 180/year+transactionfees(approximately240)

Feature Comparison Analysis

While price is important, functionality ultimately determines value. Melio excels in several key areas:

1.Payment Flexibility: Melio is the only solution offering credit card payments to vendors who don’t accept cards, a game-changing feature for cash flow management and rewards accumulation.

2.QuickBooks Integration: While QuickBooks Bill Pay has native integration, Melio’s two-way sync is more robust than Bill.com’s limited integration.

3.User Experience: Melio consistently receives higher ratings for ease of use, with a clean, intuitive interface that requires minimal training.

4.Free Plan Viability: Unlike competitors’ limited trials, Melio’s free plan is genuinely useful for small businesses with modest payment volumes.

User Experience Comparison

The user experience difference becomes apparent when comparing customer reviews:

“Bill.com felt like enterprise software that was too complex for our needs. Melio gave us all the features we needed without the complexity.” – Small Business Owner

“QuickBooks Bill Pay works well if you never leave the QuickBooks ecosystem, but Melio gives us more flexibility while still maintaining perfect QuickBooks sync.” – Bookkeeper

“We tried all three, and Melio was the only one our whole team could use without extensive training.” – Office Manager

For businesses that need reliable hosting for their websites, the same principles of finding the right balance of features, price, and usability apply.

According to a payment processor selection guide, the ideal payment solution should balance cost, functionality, and ease of use—areas where Melio consistently outperforms competitors for small business needs.

Choose the better alternative—try Melio today →

Transformation #5: International Payment Capabilities

In today’s global economy, even the smallest businesses often work with international vendors, contractors, and suppliers. Melio’s international payment capabilities remove the complexity and high costs typically associated with global transactions.

Comprehensive International Payment Options

Melio offers two primary methods for international payments:

1.International USD payments: Send US dollars to recipients worldwide

2.Local currency payments: Pay vendors in their local currency

Both options are significantly more affordable and user-friendly than traditional bank wire transfers or other international payment methods.

How International Payments Work

The process is remarkably simple:

1.Add your international vendor to Melio, including their banking details

2.Create a payment and select the international payment option

3.Choose between USD or local currency payment

4.Review the exchange rate and fees (if applicable)

5.Schedule and approve the payment

6.Melio handles the international transfer

Your vendor receives the payment directly to their bank account, with clear remittance information.

Cost Comparison with Traditional Methods

| Payment Method | Typical Fee | Processing Time | Exchange Rate Markup |

| Melio USD International | $20 flat fee | 3-5 business days | N/A |

| Melio Local Currency | Varies by currency | 3-5 business days | Competitive |

| Bank Wire Transfer | $35-50 + receiving fees | 1-5 business days | 2-4% |

| PayPal Business | 4-5% | Instant | 3-4% |

| Traditional Checks | Postage + delays | 1-3 weeks | N/A |

The savings become substantial for businesses making regular international payments. Consider this example:

Case Study: Global Design StudioMonthly international payments: 5 payments totaling 10,000Traditionalbankfees:10,000 Traditional bank fees: 10,000Traditionalbankfees:45 per transfer + 3% currency markup Monthly cost: $525Melio fees: 20pertransfer+1Monthlycost:20 per transfer + 1% currency markup Monthly cost: 20pertransfer+1Monthlycost:200Monthly savings: 325Annualsavings:325 Annual savings: 325Annualsavings:3,900

Beyond cost savings, Melio’s international payments offer several advantages:

•Simplified compliance: Melio handles regulatory requirements

•Transparent tracking: Monitor payment status from end to end

•Consistent process: Use the same workflow for domestic and international payments

•Detailed reporting: Comprehensive records for accounting and tax purposes

“We work with suppliers in six countries, and before Melio, international payments were a nightmare of paperwork and fees,” says Elena Rodriguez, an e-commerce business owner. “Now it’s as simple as paying any vendor, and we’re saving thousands in bank fees annually.”

For businesses looking to automate their marketing across borders, efficient international payment processing is an essential complement.

According to international payment trends research, businesses using specialized payment platforms like Melio save an average of 60% on international transaction costs compared to traditional banking channels.

Simplify your international payments with Melio →

Transformation #6: Free ACH Payments

One of Melio’s most compelling advantages is its generous allowance of free ACH (Automated Clearing House) payments. While competitors charge for every transaction, Melio includes a substantial number of free ACH payments with each plan.

Free ACH Allowance by Plan

| Plan | Monthly Cost | Free ACH Payments | Value of Free Payments* |

| Go (Free) | $0 | 5/month | $15-25/month |

| Core | $25 | 20/month | $60-100/month |

| Boost | $55 | 50/month | $150-250/month |

| Unlimited | $80 | Unlimited | $300+/month |

*Based on typical competitor fees of $3-5 per ACH transaction

For businesses processing numerous vendor payments, the savings from free ACH transactions alone can exceed the monthly subscription cost, effectively making Melio free or even profitable to use.

How ACH Payments Work in Melio

ACH payments are simple to set up and execute:

1.Add your vendor’s banking information to Melio

2.Create a payment and select ACH as the payment method

3.Schedule the payment date

4.Approve the payment

5.Melio processes the ACH transfer

Standard ACH payments typically take 3-5 business days to process, though Melio also offers same-day ACH for time-sensitive payments (for an additional fee).

Cost Savings Calculator

To understand the potential savings, consider this example for a small business:

Monthly ACH Payments: 30With Competitor (e.g., Bill.com):

•Monthly subscription: $45

•ACH fees: 3×30=3 × 30 = 3×30=90

•Total monthly cost: $135

With Melio (Core Plan):

•Monthly subscription: $25

•Free ACH payments: 20

•Additional ACH fees: 0.50×10=0.50 × 10 = 0.50×10=5

•Total monthly cost: $30

Monthly savings: 105∗∗Annualsavings∗∗:105 **Annual savings**: 105∗∗Annualsavings∗∗:1,260

“The free ACH payments were what initially attracted us to Melio,” explains Robert Chen, a small manufacturing business owner. “We process about 40 vendor payments monthly, and the savings compared to our previous solution are substantial—over $1,500 annually.”

For businesses also looking to optimize their checkout process, cost-effective payment processing on both ends of the transaction is essential.

According to ACH payment growth statistics, ACH transaction volume continues to increase steadily, reflecting the growing preference for this efficient, cost-effective payment method among businesses of all sizes.

Start saving on payment processing with Melio →

Transformation #7: User-Friendly Mobile App

In today’s fast-paced business environment, the ability to manage payments on the go is essential. Melio’s mobile app brings the full power of its payment platform to your smartphone, allowing you to stay on top of vendor payments from anywhere.

Key Mobile App Features

•Payment approvals: Review and approve pending payments

•Payment scheduling: Create and schedule new payments

•Payment tracking: Monitor the status of all transactions

•Vendor management: Add and edit vendor information

•Document capture: Snap photos of invoices for processing

•Notification center: Stay updated on payment activities

•QuickBooks sync: Maintain accounting integration on the go

The app is available for both iOS and Android devices, providing a consistent experience across platforms.

Benefits of Mobile Payment Management

•Prevent payment delays: Approve time-sensitive payments even when away from the office

•Improve cash flow visibility: Check payment status and upcoming obligations anytime

•Increase team efficiency: Enable approvers to review payments without being at their desk

•Capture invoices instantly: Convert paper invoices to digital format immediately

•Respond to vendor inquiries: Access payment details when vendors call with questions

The mobile experience maintains the same intuitive interface as the desktop version, requiring minimal learning curve for existing Melio users.

“The mobile app has been a game-changer for our approval process,” says Jennifer Williams, CFO of a growing service business. “I travel frequently, and before Melio, payments would often sit waiting for my return. Now I can review and approve them from anywhere, keeping our vendors happy and our operations running smoothly.”

For businesses interested in enhancing customer experience with social proof, the same principles of accessibility and convenience apply.

According to mobile business payment trends, 78% of small business owners now consider mobile payment capabilities essential, with time savings and improved cash flow management cited as the primary benefits.

Download the Melio mobile app and manage payments anywhere →

Melio Pricing Plans Explained

Melio offers a transparent, value-driven pricing structure with options for businesses at every stage of growth. Unlike competitors with complex fee structures, Melio’s pricing is straightforward and predictable.

Detailed Pricing Table

| Feature | Go (Free) | Core ($25/mo) | Boost ($55/mo) | Unlimited ($80/mo) |

| Monthly Cost | $0 | $25 | $55 | $80 |

| Users | 1 | 1 + $10/mo per additional user | 1 + $10/mo per additional user | Unlimited |

| Free ACH Payments | 5/month | 20/month | 50/month | Unlimited |

| Credit Card Payments | 2.9% fee | 2.9% fee | 2.9% fee | 2.9% fee |

| International Payments | Yes (fee applies) | Yes (fee applies) | Yes (fee applies) | Yes (fee applies) |

| Fast/Instant Payments | Yes | Yes | Yes | Yes |

| Auto-Pay | Yes | Yes | Yes | Yes |

| Pay by Card | Yes | Yes | Yes | Yes |

| AI Bill Capture | Yes | Yes | Yes | Yes |

| Batch Actions | No | Yes | Yes | Yes |

| Accounting Sync | No | Yes | Yes | Yes |

| Advanced Automations | No | No | Yes | Yes |

| Custom Controls | No | No | Yes | Yes |

| Approval Workflows | No | No | Yes | Yes |

| Best For | Solopreneurs, startups | Small businesses | Growing businesses | Established businesses |

ROI Analysis for Different Business Sizes

To understand the true value of Melio, consider the return on investment for different business types:

Solopreneur (5-10 payments/month)

•Recommended plan: Go (Free)

•Monthly cost: $0

•Time savings: ~5 hours/month

•Value of time saved: ~$250/month

•Net monthly benefit: $250

Small Business (20-30 payments/month)

•Recommended plan: Core ($25)

•Monthly cost: $25

•Time savings: ~10 hours/month

•Value of time saved: ~$500/month

•Payment processing savings: ~$60/month

•Net monthly benefit: $535

Growing Business (50+ payments/month)

•Recommended plan: Boost ($55)

•Monthly cost: $55

•Time savings: ~20 hours/month

•Value of time saved: ~$1,000/month

•Payment processing savings: ~$150/month

•Net monthly benefit: $1,095

Established Business (100+ payments/month)

•Recommended plan: Unlimited ($80)

•Monthly cost: $80

•Time savings: ~40 hours/month

•Value of time saved: ~$2,000/month

•Payment processing savings: ~$300/month

•Net monthly benefit: $2,220

“We started with the free plan to test Melio, upgraded to Core within a month, and now use the Boost plan as our business has grown,” explains Michael Chen, a retail business owner. “The ROI has been clear at every stage—we’re saving both time and money compared to our previous payment processes.”

For businesses looking to create professional voice content for their marketing, investing in efficient payment processing provides the financial foundation for growth.

According to payment processing cost analysis, businesses that optimize their payment processes save an average of 15-20% on processing costs while reducing administrative time by 40-60%.

Get started with Melio’s free plan today →

How to Get Started with Melio (Step-by-Step Guide)

Getting started with Melio is remarkably simple, with most businesses able to set up their account and process their first payment in under 10 minutes. Here’s a detailed walkthrough of the process:

1. Create Your Account

•Visit Melio through our link

•Click “Sign Up” or “Start Now”

•Enter your email address and create a password

•Verify your email address via the confirmation link

•Complete your business profile with basic information

2. Connect Your Bank Account

•Navigate to “Settings” > “Payment Methods”

•Click “Add a Bank Account”

•Choose your bank from the list of supported institutions

•Log in securely using your bank credentials

•Select the account you want to use for payments

•Verify your account ownership

Melio uses bank-level security with 256-bit encryption for all financial connections, ensuring your banking information remains secure.

3. Add Your First Vendor

•Go to the “Vendors” section

•Click “Add a Vendor”

•Enter the vendor’s name and contact information

•Add payment details (bank account or mailing address)

•Save the vendor to your database

You can add vendors individually or import them in bulk via CSV file if you’re migrating from another system.

4. Schedule Your First Payment

•Navigate to the “Pay” section

•Select the vendor from your list

•Enter the payment amount and due date

•Choose your preferred payment method

•Upload or link an invoice (optional)

•Review and confirm the payment details

Once scheduled, you’ll receive confirmation and can track the payment status through the dashboard.

5. Set Up QuickBooks Integration (Optional)

•Go to “Settings” > “Integrations”

•Select QuickBooks and click “Connect”

•Log in to your QuickBooks account when prompted

•Choose which data to sync (vendors, bills, payments)

•Set your sync preferences

•Complete the connection

After connecting, you can customize which elements sync and how frequently.

6. Invite Team Members (Optional)

•Navigate to “Settings” > “Team & Permissions”

•Click “Invite Team Member”

•Enter their email address and set permissions

•Configure approval rules if needed

•Send the invitation

Team members will receive an email invitation to create their Melio account with the appropriate access level.

“The setup process was incredibly smooth—much easier than I expected,” says Lisa Johnson, a service business owner. “We were up and running in minutes, and the interface was intuitive enough that we didn’t need any training to get started.”

For businesses that also need reliable hosting for their websites, the same principles of straightforward setup and user-friendly interfaces are crucial.

According to the Digital Payment Adoption Guide from the Small Business Administration, businesses should prioritize payment solutions with simple setup processes and strong security features—areas where Melio excels.

Set up your Melio account in under 10 minutes →

Real Business Success Stories with Melio

The true measure of any business solution is the impact it has on real companies. Here are two compelling success stories from businesses that have transformed their payment processes with Melio:

Case Study #1: Riverfront Retail

Business Profile:

•Small retail business with three locations

•12 employees

•75+ vendor payments monthly

•Previously using paper checks and bank transfers

Challenges:

•Payment processing took 15+ hours weekly

•Frequent late payment fees ($150-200 monthly)

•No integration with QuickBooks

•Limited cash flow visibility

•Unable to maximize credit card benefits

Melio Solution:

•Implemented Melio Core plan

•Set up QuickBooks integration

•Converted 60% of payments to credit card

•Automated recurring payments

Results:

•Reduced payment processing time by 80%

•Eliminated late payment fees completely

•Streamlined accounting with automatic QuickBooks sync

•Earned $7,200 in credit card rewards annually

•Total annual savings: $18,500

“Melio has completely transformed how we handle vendor payments,” says Sarah Thompson, owner of Riverfront Retail. “What used to take days now takes minutes, and the QuickBooks integration has eliminated the accounting headaches we used to face every month.”

Case Study #2: Precision Consulting Group

Business Profile:

•Professional service firm with 15 consultants

•Distributed team across multiple states

•100+ payments monthly to contractors and vendors

•Previously using a combination of payment methods

Challenges:

•Complex approval process causing payment delays

•Difficulty managing international contractor payments

•No mobile access for traveling executives

•High payment processing fees

•Manual reconciliation with accounting system

Melio Solution:

•Implemented Melio Boost plan

•Established multi-level approval workflows

•Utilized international payment capabilities

•Deployed mobile app for traveling team members

Results:

•Reduced payment approval time from 5 days to 1 day

•Saved 30% on international payment fees

•Enabled on-the-go payment approvals

•Improved contractor satisfaction with timely payments

•Total annual savings: $22,000

“As a distributed team, we needed a payment solution that worked regardless of where our people were located,” explains Michael Rodriguez, Operations Director at Precision Consulting. “Melio’s mobile capabilities and approval workflows have eliminated the bottlenecks we used to face, and our contractors appreciate the consistent, timely payments.”

These success stories reflect the experience of thousands of small businesses using Melio to streamline their payment processes. While results vary based on business size and payment volume, the consistent themes are significant time savings, cost reduction, and improved financial operations.

For businesses looking to streamline their marketing operations alongside their payment processes, these efficiency gains provide a solid foundation.

According to payment automation ROI studies, businesses implementing dedicated payment solutions like Melio typically see a 400-600% return on investment within the first year, primarily through time savings and error reduction.

Join thousands of successful businesses using Melio →

Frequently Asked Questions

Is Melio really free to use?

Yes, Melio offers a completely free plan that includes 5 free ACH payments per month. This plan is perfect for solopreneurs and very small businesses with limited payment needs. You only pay for premium features or when you exceed the free transaction limit.

How does paying by credit card work if my vendor doesn’t accept cards?

Melio’s unique technology allows you to pay by credit card, and Melio will send the funds to your vendor via ACH transfer or check. You get the benefits of paying by card (rewards, extended float) while your vendor receives their preferred payment method. Melio charges a 2.9% fee for this service.

Is Melio secure?

Absolutely. Melio uses bank-level security with 256-bit encryption and is SOC 2 Type II compliant. Your financial data is protected with the highest industry standards, including secure connections, data encryption, and regular security audits. Melio never stores your bank credentials.

How long does it take for vendors to receive payment?

Standard ACH transfers typically take 3-5 business days. Checks take 5-7 business days to arrive. For urgent payments, same-day options are available for an additional fee. International payments generally take 3-5 business days, depending on the destination country.

Can I use Melio if I don’t use QuickBooks?

Yes! While Melio integrates seamlessly with QuickBooks, it works perfectly as a standalone payment solution. You can also export payment data to other accounting systems. Many businesses use Melio without any accounting software integration.

Are there any hidden fees?

No hidden fees. Melio is transparent about all costs: free ACH payments (within monthly limits), 2.9% for credit card payments, and flat fees for expedited or international payments. All fees are clearly displayed before you confirm any payment.

How many users can access my Melio account?

The free plan supports one user. Paid plans allow additional users for $10/month each, with the Unlimited plan supporting unlimited users at no extra cost. Each user can have customized permissions and approval roles.

Can I pay international vendors with Melio?

Yes, Melio supports international payments in both USD and local currencies. International payments carry a flat fee of $20 for USD or variable fees for local currency payments. Melio handles all the complexity of international transfers, making them as simple as domestic payments.

For businesses looking to optimize their payment processing while ensuring security, Melio provides detailed information on their B2B payment security best practices.

Conclusion: Transform Your Payment Process Today

In today’s competitive business environment, every minute saved and every dollar optimized contributes directly to your bottom line. Melio payment processing delivers on both fronts, providing a rare combination of time savings, cost reduction, and enhanced payment flexibility.

We’ve explored the seven transformative ways Melio is changing small business finance:

1.Pay any vendor by credit card (even when they don’t accept cards)

2.Seamless QuickBooks integration for streamlined accounting

3.Automated payment scheduling and reminders to eliminate late fees

4.Flexible payment approval workflows for growing teams

5.International payment capabilities at competitive rates

6.Free ACH payments to reduce processing costs

7.User-friendly mobile app for on-the-go management

These features combine to create a payment solution that delivers exceptional value for small businesses across all industries. Whether you’re processing 5 payments monthly or 500, Melio offers a plan that fits your needs and budget.

The benefits are clear:

•Save valuable time by automating payment processes

•Reduce costs through free ACH payments and eliminated late fees

•Improve cash flow with flexible payment options

•Earn rewards on vendor payments

•Simplify accounting with seamless integrations

•Scale effortlessly as your business grows

Start your free Melio account today →

Join the 100,000+ small businesses already using Melio to streamline their payments and focus on what matters most—growing their business.

For a comprehensive suite of business tools, also explore our recommendations for e-commerce checkout optimization and marketing automation.

According to the Future of Business Payments Report, businesses that adopt digital payment solutions like Melio are positioned to save up to 80% on payment processing costs while reducing payment processing time by 75%. Don’t let outdated payment processes hold your business back—embrace the future of B2B payments with Melio.